Excellent Suggestions Concerning Residence Mortgages That You Will Want To Read

Authored by-Vaughn Medlin

Every American dreams to own the perfect home of his or her own. If you are searching for your first home but are unsure of the mortgage financing process, this is the perfect article for you. Use the information in the following paragraphs to learn the key tips you need to understand to help you get a great deal on your mortgage financing.

When it comes to getting a good interest rate, shop around. Each individual lender sets their interest rate based on the current market rate; however, interest rates can vary from company to company. By shopping around, you can ensure that you will be receiving the lowest interest rate currently available.

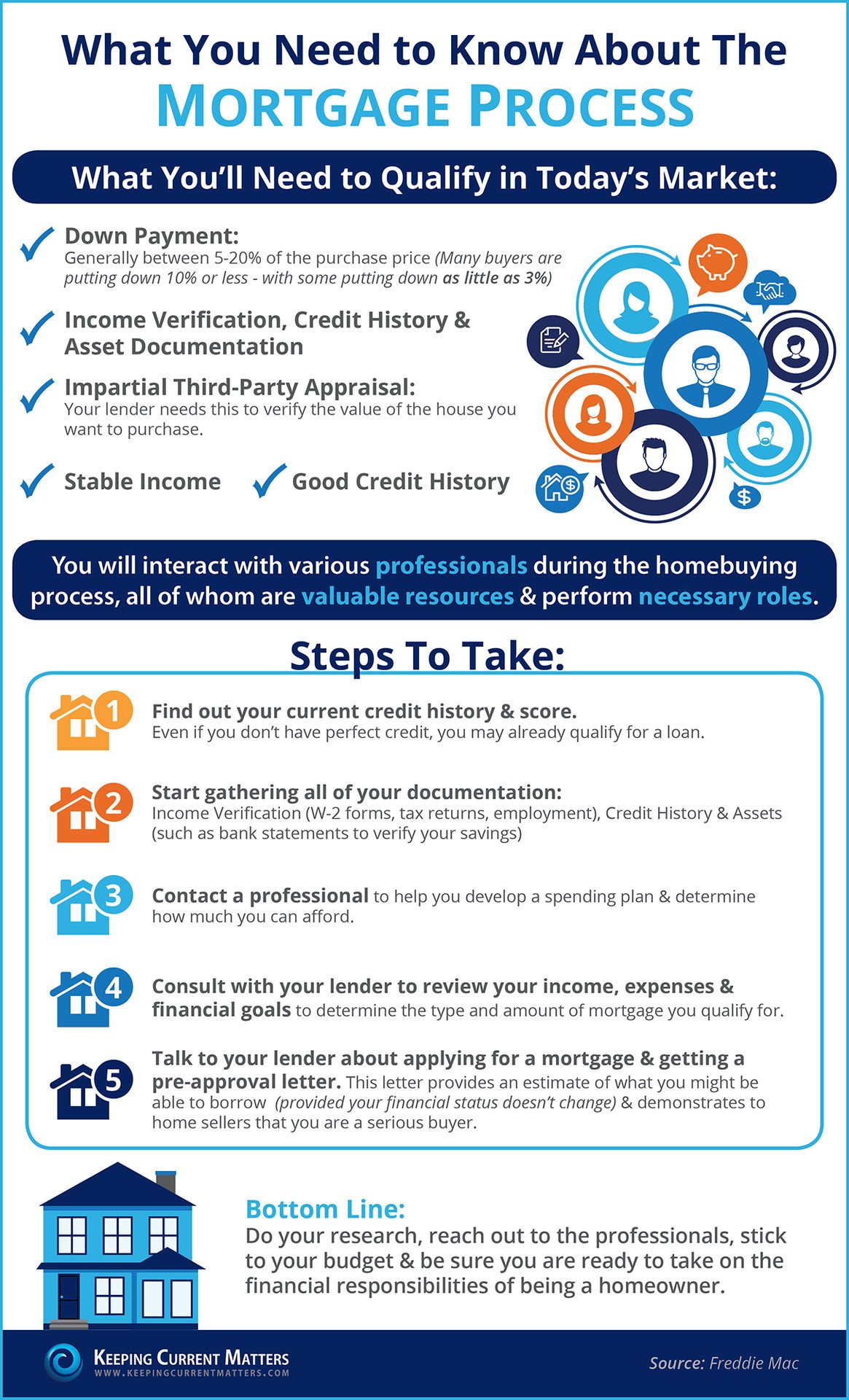

To make your application for a mortgage fast and easy, make electronic copies of your last two pay checks, two recent bank statements, W2s, and tax information. Lenders will ask for all of this information to go with the application and having them on hand in electronic format makes it easy to supply this information.

There are loans available for first time home buyers. These loans usually do not require a lot of money down and often have lower interest rates than standard mortgages. Most first time home buyer loans are guaranteed by the government; thus, there is more paperwork needed than standard mortgage applications.

While you wait to close on your mortgage, avoid shopping sprees! The credit is rechecked after several days before the mortgage is actually finalized. Make large purchases after the mortgage is signed and final.

Know what the going interest rate is. This will help you know when to lock in an interest rate. Many mortgage companies offer to lock you into a particular interest rate for a period of 30 to 60 days. If the interest rates increase, you are protected. If they decline you can opt for the new interest rate.

When financing a house, giving a large down payment will result in a lower mortgage rate. This is due to the fact that a big down payment will reduce your loan to value ratio. When the loan to value ratio gets lower, the interest rates become more favorable for the home buyer.

Know your credit score before going in to get a mortgage. Your potential lender will do their own homework on this, but you should arm yourself with the intel as well. Knowledge is power in terms of the negotiations to follow. If you aren't clear on your strengths and weaknesses, then a lender can more easily use the knowledge against you.

Save your money. When you are going to finance a home mortgage, you will need to have some cash for a down payment. The more money you pay down, the lower your payments and interest rates. The down payment goes directly to the principal of the mortgage and is a sum you will not owe yearly interest on.

Look into no closing cost options. If closing costs are concerning you, there are many offers out there where those costs are taken care of by the lender. The lender then charges you slightly more in your interest rate to make up for the difference. This can help you if immediate cash is an issue.

Pay your credit cards on time if you are considering a home mortgage in the next few years. Your credit score and debt to income ratios will come into play when you go for a home mortgage. If you have multiple late payments or are carrying a lot of debt, you may find the mortgage offers you receive to be poor.

Get at least three mortgage offers before deciding on which one to go with. Home mortgages, like many other loans, will vary in their costs and rates from lender to lender. What you think is a good deal may not be, so it's important to see multiple options before making a decision.

Answer every question on your home mortgage application absolutely honestly. There is no benefit in lying, as all of the information that you provide will be thoroughly examined for accuracy. Additionally, https://gulfnews.com/business/banking/saudi-central-bank-extends-guaranteed-funding-programme-for-small-businesses-1.1647086875880 could easily lead to your denial, so just be honest from the start so that you have the best chances.

Cut down on the credit cards you use before you get a house. You look financially irresponsible if you have many credit cards. You shouldn't have lots of credit cards if you want a good interest rate.

Go Suggested Site and use a mortgage calculator to find out how much of a loan you can afford. There are many sites that offer these free calculators. Additionally, there are calculators that will tell you the final price you will be paying at the end of the loan and others that show how much you can save by paying extra toward the principal.

Ask around about mortgage financing. You may be surprised at the leads you can generate by simply talking to people. Ask your co-workers, friends, and family about their mortgage companies and experiences. They will often lead you to resources that you would not have been able to find on your own.

Before you contact a mortgage lender to apply for a loan to buy a home, use one of the fast and easy mortgage calculators available online. You can enter your loan amount, the interest rate and the length of the loan. The calculator will figure the monthly payment that you can expect.

Compare mortgages in order to get the best one. You will want the best interest rate. On top of that, you need to investigate all the different loan types. There are many other things to consider before deciding on a loan. These include the closing costs, down payment and lender commissions.

Investigate preapprovals before you start home shopping. Preapproved mortgages will give you an idea of both how much home you can afford plus what your monthly mortgage payments will be. This will set the parameters of your home shopping and save you time not looking at properties you can't realistically afford.

So many people rush into the home buying process without preparing the financial situation properly in order to get approved for a home mortgage. This can unfortunately delay the process if you get denied. Then you are left wondering what you need to do to get approved. Thankfully the tips presented here should get you prepared on what is needed to get that dream home of yours.